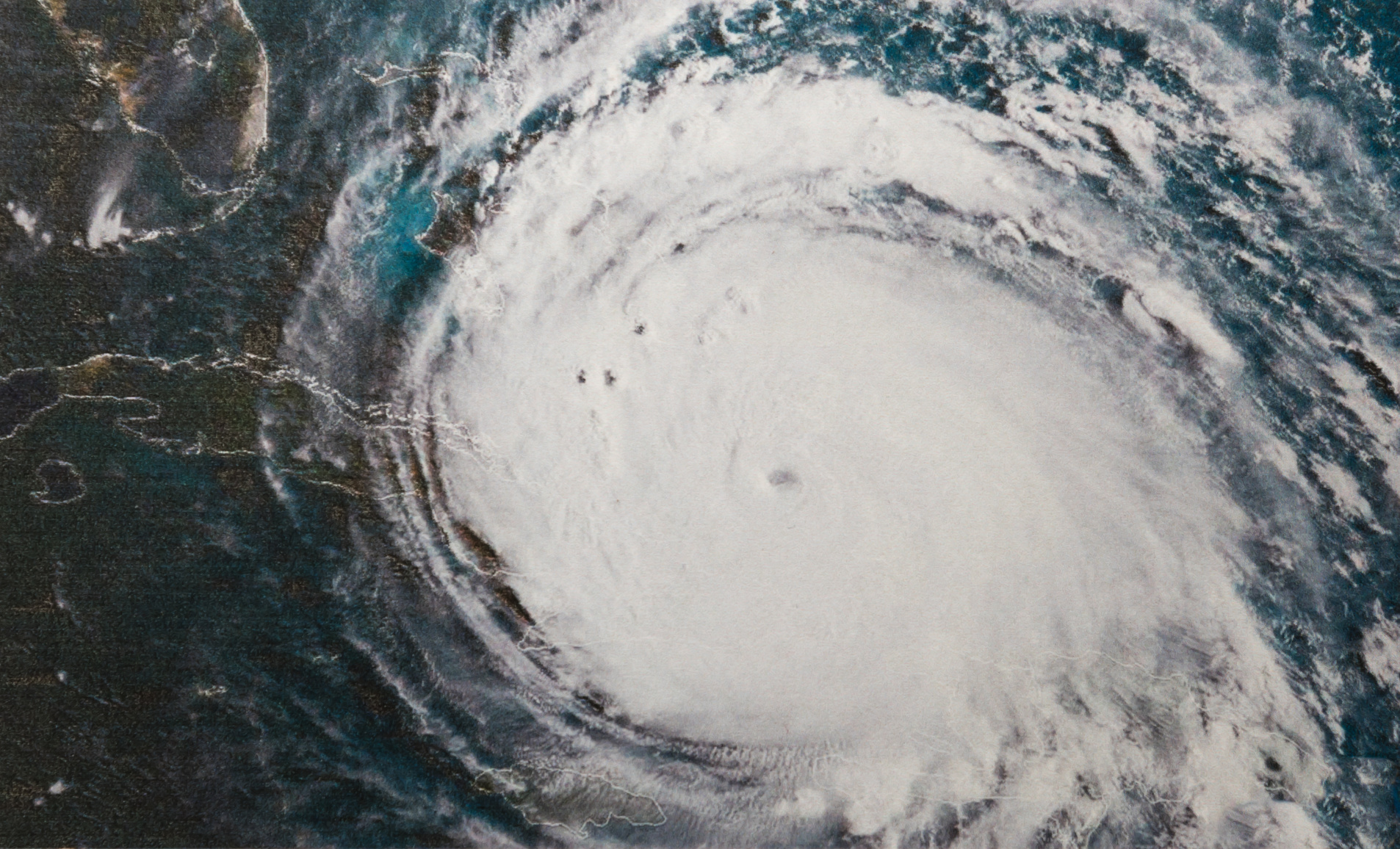

After Hurricane Devastation, Tim Moore Delivers IRS Tax Relief for North Carolina

The IRS has officially extended tax filing and payment deadlines for North Carolina residents affected by Hurricane Helene, moving the deadline from May 1 to September 25, 2025. The decision follows a bipartisan request led by Congressman Tim Moore (NC-14) and backed by the entire North Carolina congressional delegation.

On April 3, Moore and his colleagues urged the IRS to grant the extension, citing the storm’s severe damage and the ongoing delays in recovery efforts. Less than two weeks later, the IRS responded with sweeping relief, applying to all 100 counties in the state as designated by FEMA.

Under the new guidance, individuals, businesses, and tax-exempt organizations in North Carolina now have until September 25, 2025, to file returns and make payments originally due between September 25, 2024, and the same date in 2025. This includes income tax filings, quarterly estimated payments, payroll taxes, and corporate or nonprofit returns. Contributions to IRAs and HSAs for the 2024 tax year are also included, along with extended deadlines for filers with valid extensions for tax year 2023—though payments due before the hurricane are not covered.

Relief will be applied automatically to those with an IRS address of record in the affected area. Taxpayers who moved into the area or whose records are in the disaster zone but reside elsewhere may still qualify by contacting the IRS directly at 866-562-5227. This also applies to relief workers affiliated with recognized government or nonprofit organizations.

Taxpayers needing additional time to file beyond September 25 can request an extension until October 15, 2025, by submitting Form 4868 by mail. However, payments are still due by the September deadline.

Individuals and businesses suffering uninsured or unreimbursed disaster-related losses may claim them on either their 2023 or 2024 tax return. These losses must be clearly tied to the storm and filed with FEMA declaration number 3617-EM. Additionally, qualified disaster relief payments are excluded from taxable income, and certain early retirement plan distributions may be exempt from the 10% penalty if related to recovery expenses.

Other forms of assistance include hardship withdrawals and reasonable cause penalty abatements for those who don’t qualify for disaster relief but can demonstrate legitimate obstacles in filing or paying on time.

The IRS has made it clear that this extension is part of a coordinated federal effort to support families, workers, and small businesses still reeling from the impact of Hurricane Helene. For Congressman Tim Moore, the announcement represents a meaningful win in the fight to deliver practical, timely relief to his constituents. His leadership in rallying bipartisan support underscores his continued commitment to helping North Carolina recover—not just from the storm, but from the burdens that follow.

RECENT

BE THE FIRST TO KNOW

More Content By

Think American News Staff