No Tax, Big Savings: Lawmakers Highlight Tennessee’s Back-to-School Tax Holiday

Tennessee families will have a welcome opportunity to save on essential school and personal items later this month, as the state’s annual back-to-school sales tax holiday returns from Friday, July 25 through Sunday, July 27. Several state lawmakers are urging residents to take advantage of the tax-free weekend—not just for back-to-school shopping, but to help stretch household budgets in a time of rising costs.

Among those leading the charge are State Reps. Fred Atchley, Andrew Farmer, and Kevin Vaughan. Together, they’re promoting the event as a common-sense way to provide financial relief to working families across the state. “We’ve worked hard to return Tennesseans’ hard‑earned money to their pockets through responsible, conservative budgeting,” said Atchley and Farmer in a joint statement. “We hope every family, not just those with students heading back to school, will take advantage of this opportunity to stock up and save on essential items.” Vaughan echoed the sentiment in his own release, adding, “This is a great way for families to save on essential school supplies. From clothing and backpacks to laptops and notebooks, this weekend helps parents stretch their budgets during the back-to-school season.”

The three-day tax break exempts qualifying purchases from state sales tax—both in stores and online—as long as the items meet Tennessee’s eligibility criteria and are for personal, not business, use. Eligible items include clothing and footwear priced at $100 or less per item, such as shirts, pants, socks, shoes, and dresses. School and art supplies priced at $100 or less per item, including backpacks, crayons, paper, pencils, binders, and calculators, are also tax-free. Computers, laptops, and tablets intended for personal use and priced at $1,500 or less also qualify for the exemption. Residents can expect the tax break to be automatically applied at checkout, whether they’re shopping in person or online. For a complete list of what is and isn’t included, shoppers are encouraged to visit www.tntaxholiday.com or the Tennessee Department of Revenue’s website.

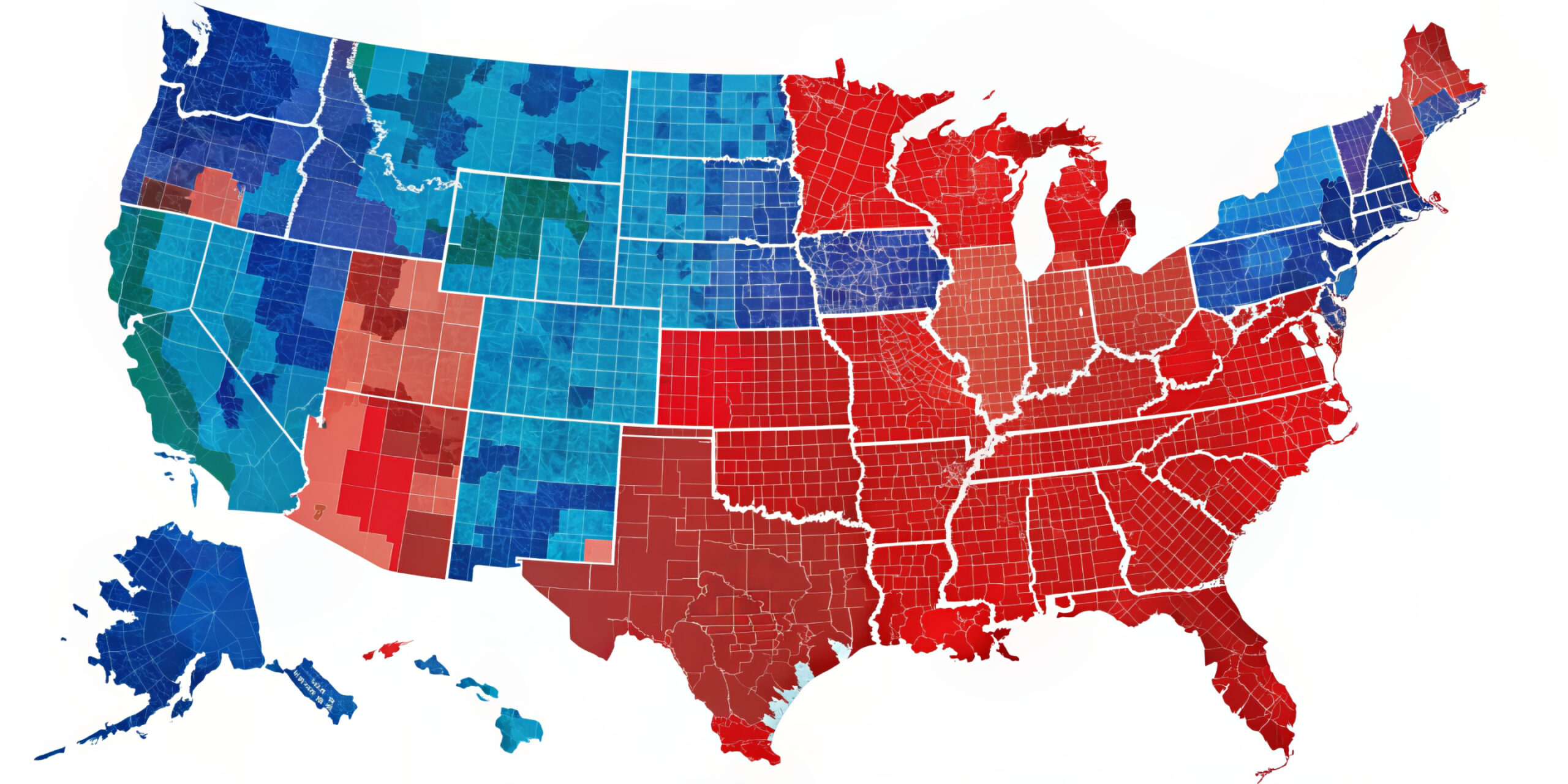

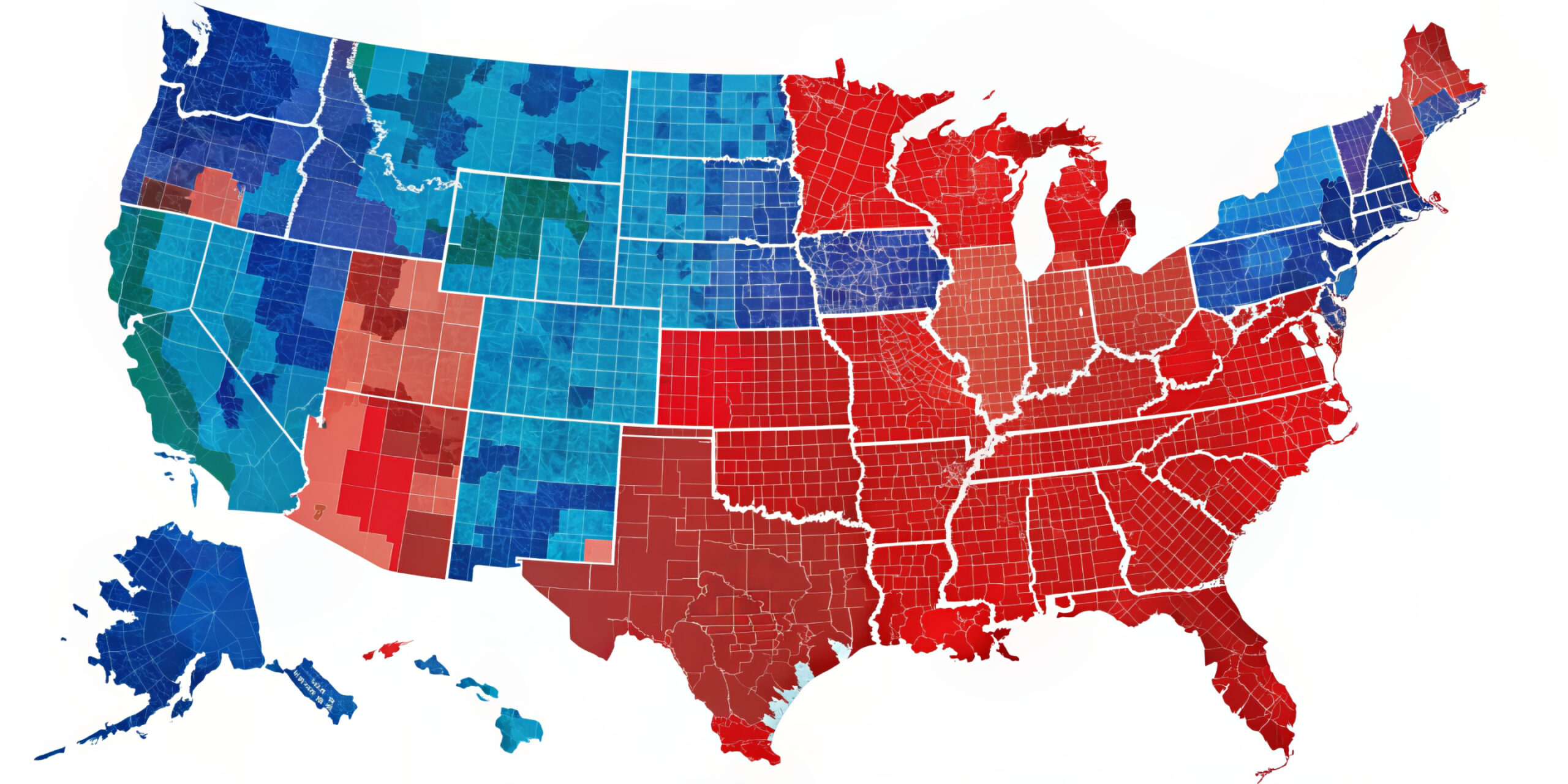

Tennessee isn’t alone in offering a back-to-school sales tax holiday. Many states across the country have similar programs aimed at easing financial burdens for families. States like Texas, Florida, South Carolina, Virginia, Iowa, Missouri, and others typically host tax-free weekends during July or August. Some focus exclusively on school-related items, while others include technology, energy-efficient appliances, or even hurricane preparedness supplies. Dates and qualifying items vary by state, so those outside Tennessee should check with their state’s Department of Revenue to find out if a tax holiday is scheduled where they live and what items are eligible.

These sales tax holidays are just one way states can offer meaningful relief to families. Since 2012, Tennessee’s Republican-led General Assembly has passed more than $5.1 billion in tax cuts. With no personal income tax and a reputation for fiscal responsibility, the state continues to be one of the lowest-taxed in the nation. Lawmakers say this policy approach isn’t just about numbers—it’s about helping people meet real needs, especially as inflation and rising costs continue to impact everyday life.

“At the end of the day, it’s about making life a little easier for the people we serve,” said Farmer. “This is a practical, helpful way to do that.” With the back-to-school season fast approaching, families are encouraged to plan their purchases and take full advantage of the upcoming sales tax holiday. Whether preparing for a new school year or stocking up on household essentials, Tennessee’s tax-free weekend is a timely opportunity to save.

RECENT

BE THE FIRST TO KNOW

More Content By

Think American News Staff